41 us treasury bonds coupon rate

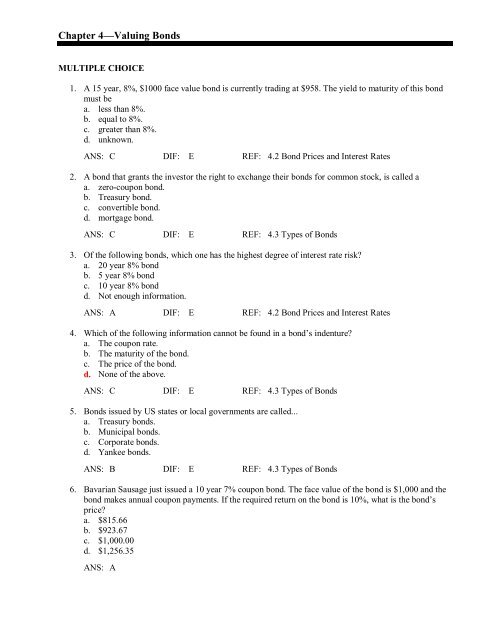

Front page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues . Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America’s Finances. Monthly Treasury Statement. Daily Treasury Statement. How Your Money Is Spent. USAspending.gov. National Debt. National Debt to the Penny. Historical Debt Outstanding. Monthly Statement of the Public … HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

home.treasury.gov › policy-issues › tax-policyForeign Account Tax Compliance Act | U.S. Department of the ... FATCA requires foreign financial institutions (FFIs) to report to the IRS information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations (and FFI agreement, if applicable) or comply with the FATCA Intergovernmental ...

Us treasury bonds coupon rate

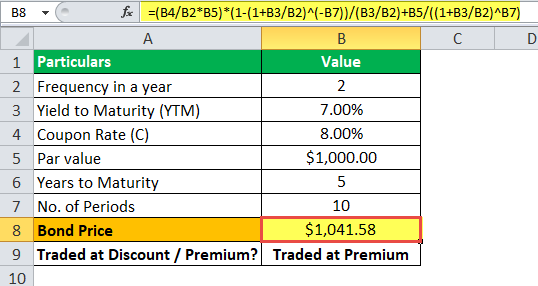

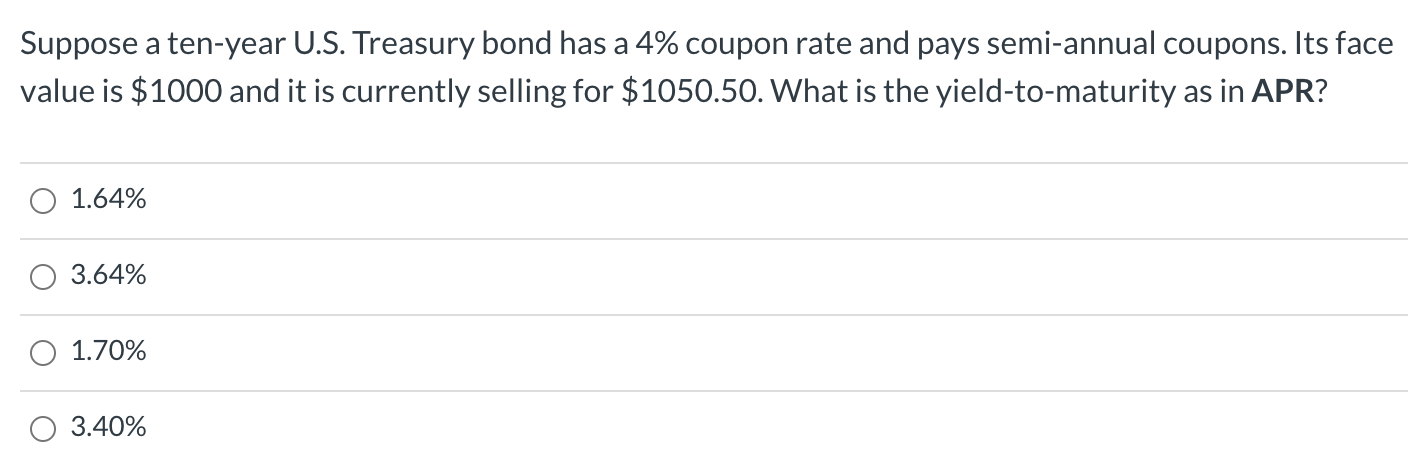

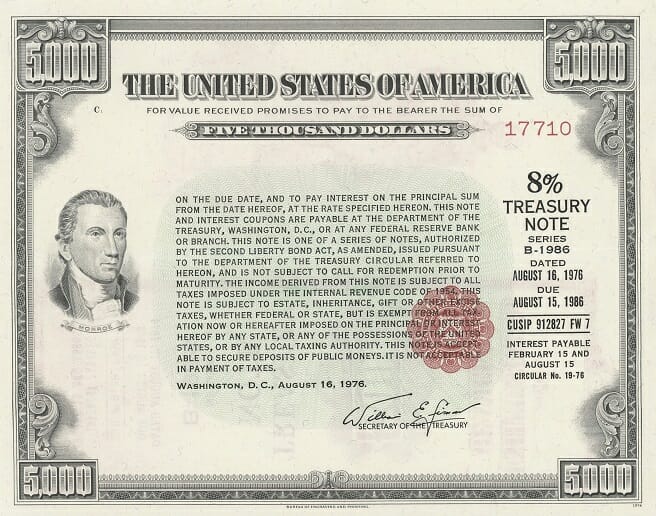

How to Buy Treasury Bonds: 9 Steps (with Pictures) - wikiHow 06.05.2021 · In addition to par value, bonds are sold at a given "interest rate," which is the percentage of the bond par value the bond will pay in interest every six months. Treasury bonds pay the holder each six months. Here is an example of a treasury bond with a par value of $100 and an interest rate of 5 percent. Before the auction, bidders already ... › market-data › bondsTreasuries - WSJ Market Data Center. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Treasuries - WSJ We are in the process of updating our Market Data experience and we want to hear from you. Please send us your feedback via our Customer Center

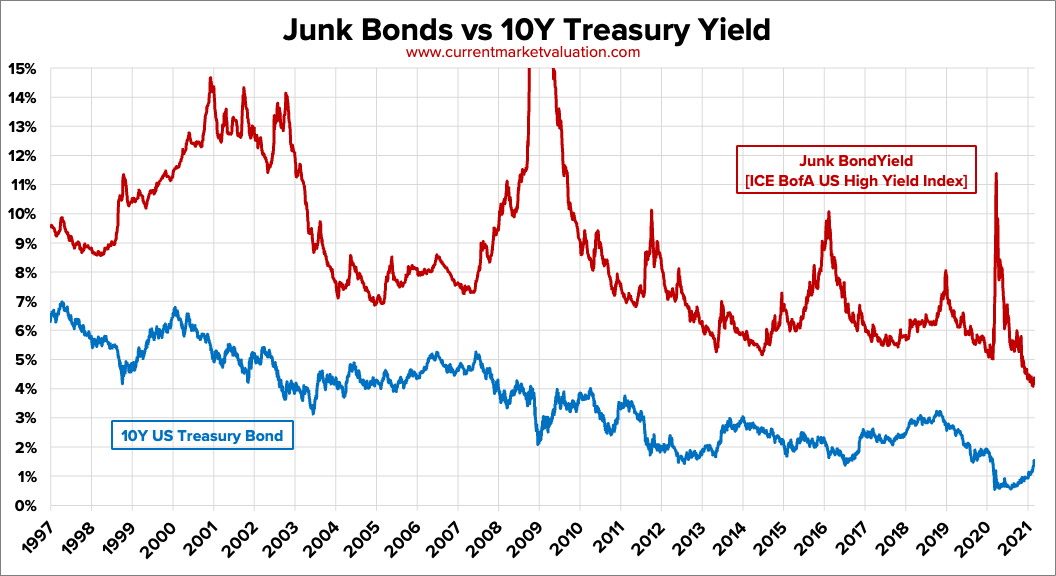

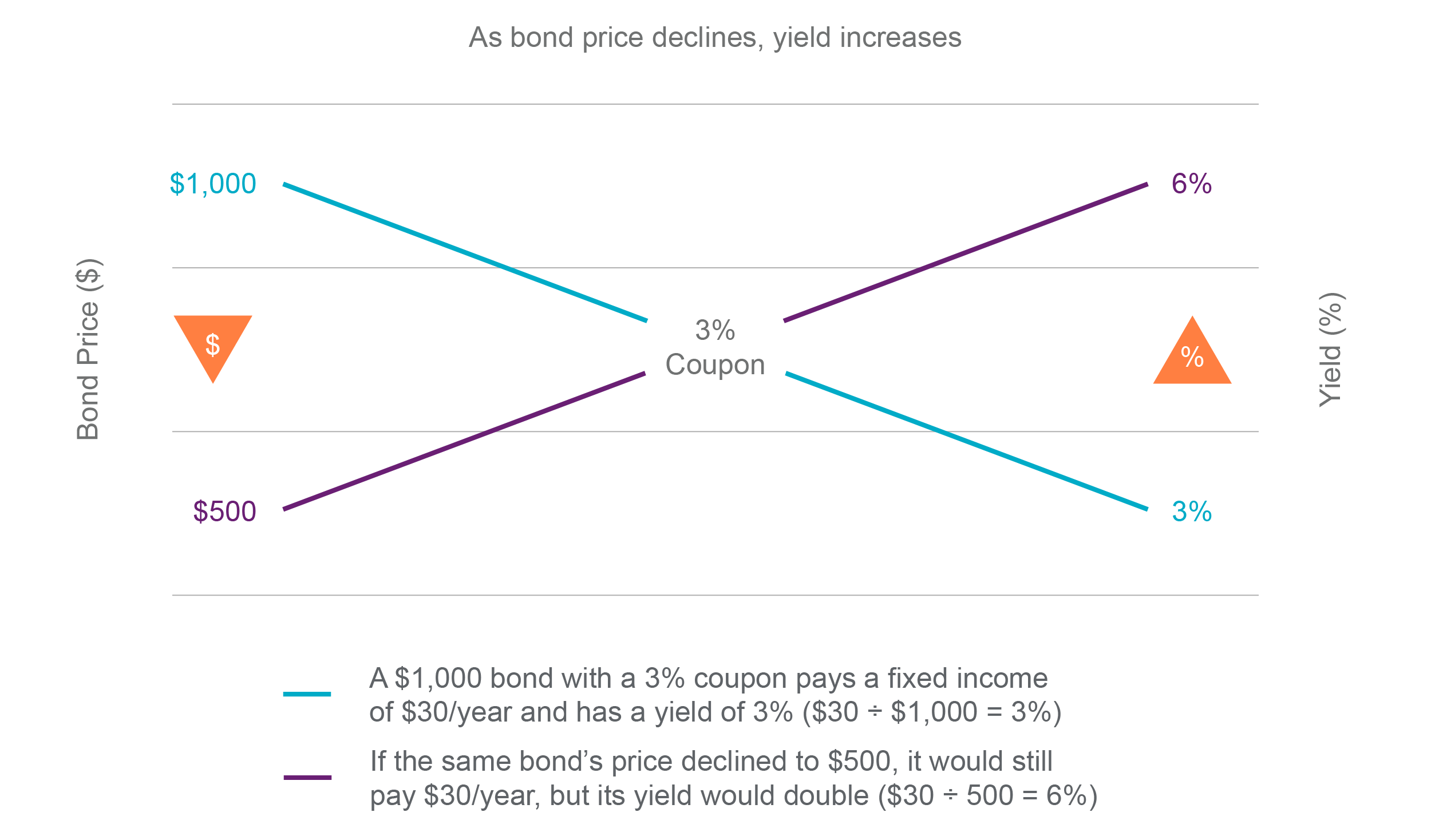

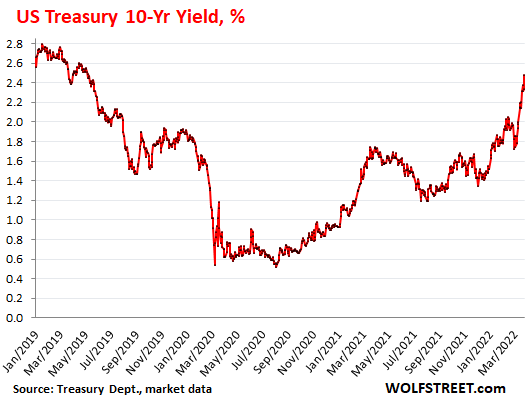

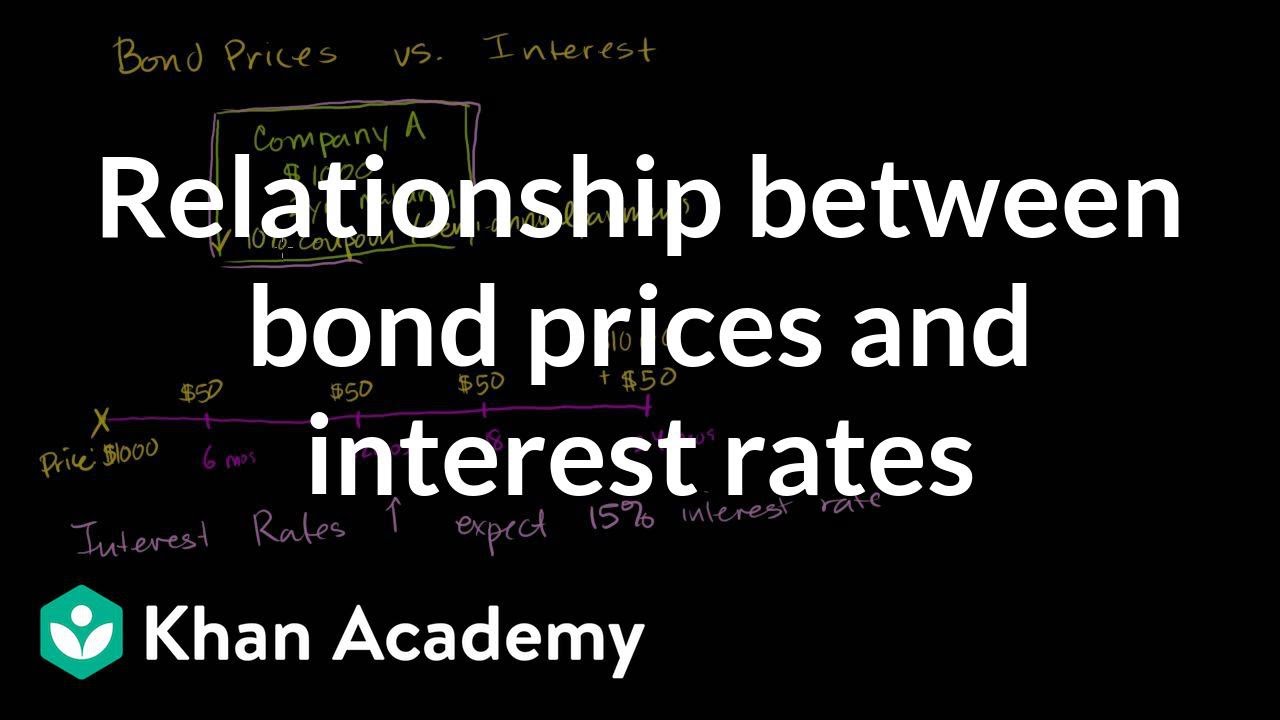

Us treasury bonds coupon rate. › us-treasury-bondsUS Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data › markets › rates-bondsUnited States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month . 0. ... United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. As the U.S. government used budget surpluses to pay down federal debt in the late …

Foreign Account Tax Compliance Act | U.S. Department of the Treasury FATCA requires foreign financial institutions (FFIs) to report to the IRS information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations (and FFI agreement, if applicable) or comply with the FATCA … US Treasury Bonds - Fidelity US Treasury bonds: $1,000: Coupon: 20-year 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) $1,000: Coupon: 5-, 10-, and 30-year : Interest paid semi-annually, principal redeemed at the greater of their inflation-adjusted principal amount or the original principal amount: US Treasury floating rate notes (FRNs) $1,000: … Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data home.treasury.gov › policy-issues › financialOFAC Recent Actions | U.S. Department of the Treasury Exchange Rate Analysis. ... Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. ... Savings Bonds - Treasury Securities.

› marketsStock Market Data – US Markets, World Markets, After Hours ... Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity. Treasury Bonds: A Good Investment for Retirement? - Investopedia 25.05.2022 · Treasury notes or T-notes are very similar to Treasury bonds in that they pay a fixed rate of interest every six months until their maturity. However, Treasury notes have shorter maturity dates ... OFAC Recent Actions | U.S. Department of the Treasury Remarks by Secretary of the Treasury Janet L. Yellen on the Biden-Harris Administration’s Economic Agenda in Ohio October 17, 2022 Enhancing the US-UK Sanctions Partnership Treasuries - WSJ We are in the process of updating our Market Data experience and we want to hear from you. Please send us your feedback via our Customer Center

› market-data › bondsTreasuries - WSJ Market Data Center. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

How to Buy Treasury Bonds: 9 Steps (with Pictures) - wikiHow 06.05.2021 · In addition to par value, bonds are sold at a given "interest rate," which is the percentage of the bond par value the bond will pay in interest every six months. Treasury bonds pay the holder each six months. Here is an example of a treasury bond with a par value of $100 and an interest rate of 5 percent. Before the auction, bidders already ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/Treasury-yield_final-40eecf2eabbe467da15e4b7d7ea949ff.png)

:max_bytes(150000):strip_icc()/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

Post a Comment for "41 us treasury bonds coupon rate"