40 step up coupon bonds

Coupon Bond - Guide, Examples, How Coupon Bonds Work Nevertheless, the term "coupon" is still used, but it merely refers to the bond's nominal yield. How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These ... B step up note C zero coupon bond Explanation Deferred coupon bonds ... B step up note C zero coupon bond Explanation Deferred coupon bonds carry. B step up note c zero coupon bond explanation. School Oxford Brookes; Course Title MARKETING 4001; Uploaded By solomongoredema. Pages 958 This preview shows page 630 - 633 out of 958 pages.

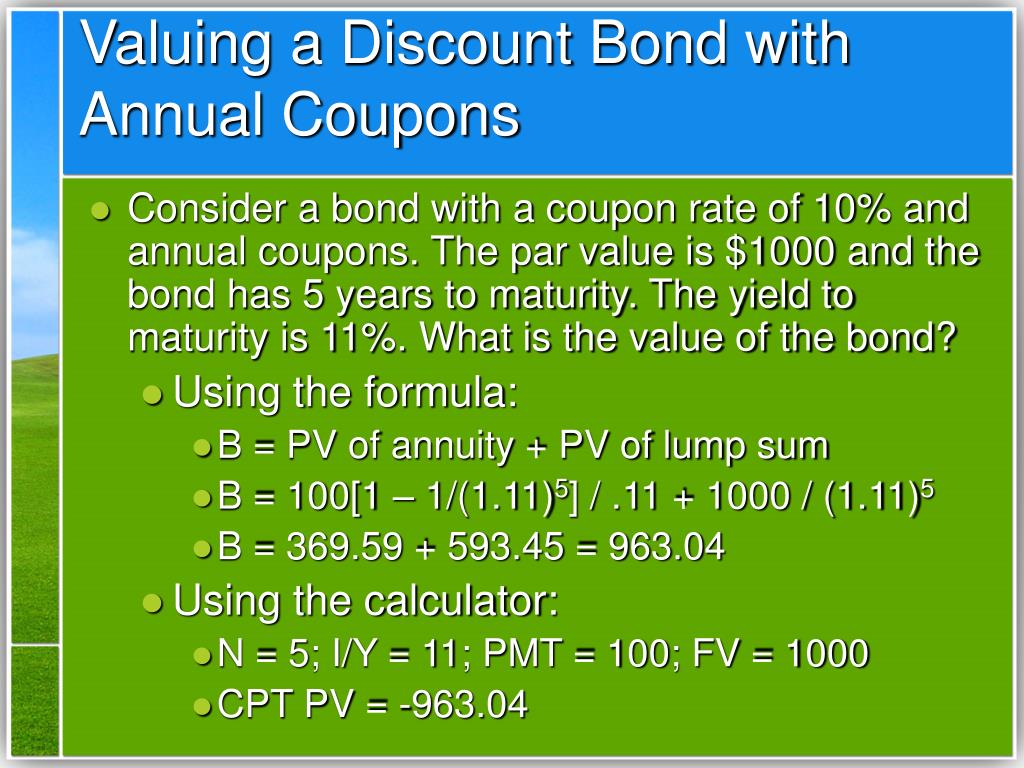

How to calculate the yield to maturity for a step-up coupon bond - Quora Answer (1 of 2): If you want to give me the cusip and the dollar price, I can do it for you on Bloomberg, otherwise you can plot the cash flows on your own and use your calculator or Microsoft excel Internal rate of return function. But here's the thing, the vast majority of step-up notes do NOT ...

Step up coupon bonds

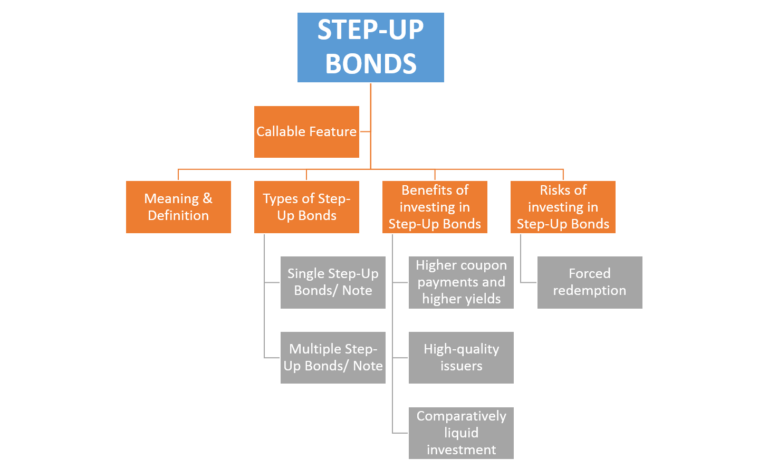

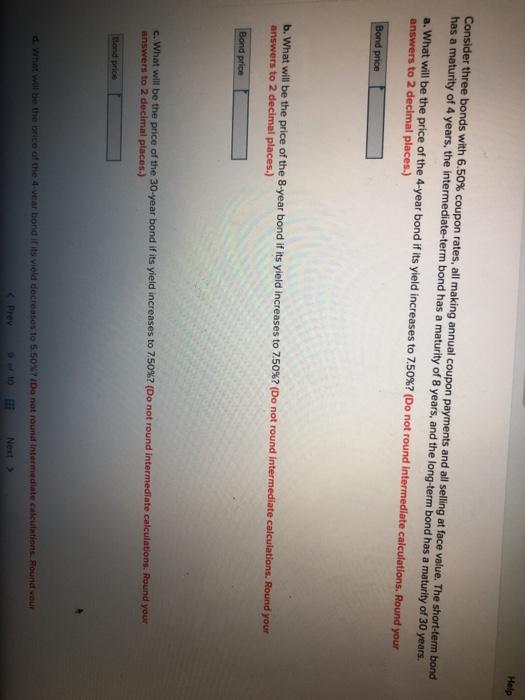

What is a Step-Up Bond? - Accounting Hub A step-up bond comes with a lower interest rate initially. Its interest rate steps up after a specific period as described by the issuer. The interest rate of this bond can increase over specified intervals and up to a specified extent. It can be a single increase in the interest rate and several hikes depending on the terms of the bond. What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to... Step-Up Bonds | Meaning, Single, Multiple, Callable Bonds, Benefits-Risks Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

Step up coupon bonds. Step-Up Coupon Securities financial definition of Step-Up Coupon Securities Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Also called dual coupon bond, rising-coupon security, step-up coupon security. Step-Up Coupon Bond - Harbourfront Technologies A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases. What are Step-up Bonds? Example, Types, Advantages, and Disadvantages The coupon rate of the bond increases to 5% in its final year. It means the lender will receive $30 for each of the first two years, $45 for year two and year three, and finally receive $50 in the last year. The lender will also receive $1,000 on the maturity of the bond, as usual. Types of Step-Up Bonds Step Up Bonds: Pros and Cons - Management Study Guide Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period.

Stepped coupon bond financial definition of stepped coupon bond A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Step-Ups - Types of Fixed Income Bonds | Raymond James Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period. PDF Understanding Callable Step-up Investment Products Multi Step-Up A multi step-up bond may adjust many times during the life of the investment, if it is not called. For example, a 15-year multi step-up certificate of deposit may begin with a coupon rate of 5.00 percent in year one and adjust in increments to reach 13.00 percent in year 15. Typically, the coupon paid on a callable step-up bond is Step-Up Bond Definition - Investopedia Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases in the coupon...

Step-Up Bonds Definition & Example | InvestingAnswers A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ. Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond. Calling munis is too pricey | Bond Buyer The combined cashflows of the 3.50% callable bond and the 2.61% refunding bond will be the same as that of the step-up coupon bond. Clearly the issuer should prefer the 3% optionless bond to the 3 ... Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S 703

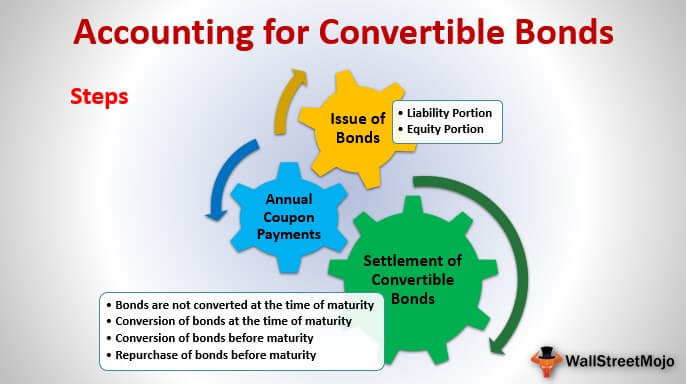

Accounting for Step-Up Bond | Example | Advantage - Accountinguide Step Up Bond provide benefit to the holders while having some negative impact on the issuers. Step Up Bond Example Company ABC issues the step-up bond at $ 1,000 per bond. The initial coupon rate was 2%, and it will keep increasing 50% every year over the 5 years lifetime.

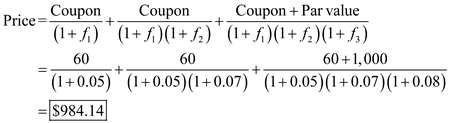

Finance | Step-Up Bond Step-Up Coupon Bond A bondwith interest coupons that change to preset levels on specific dates. More specifically, the bond pays a given coupon for a specific period of time, then its coupon is stepped up in regular periods until maturity. For instance, a bond may pay 6% interest for

PDF An Analysis of Step-Up Fixed Income Securities The step-ups may not be better than a fixed income bond. If what drew you to the step-up was those big yield numbers, think again. Considerations What are some of the considerations in purchasing these step-up ... Step-Up CD Date- Coupon Rate Actual Yield to Date Actual Yield to Date 01/20/2017 - 2.000% 2018 - 2% 2018 - 1% ...

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Telco Step-Up Coupon Bonds Touted As of last Wednesday, France Telecom's 6.75% of '08, which features a step-up was trading at 155 over swaps, while the company's 6.625% of '10 plain vanilla bond, was at 119 over. Deutsche...

Deferred Coupon Bonds: Definition, How It Works, Types and More Step-Up Bonds These bonds do not make coupon payments until a certain period. For instance, a bond can start interest payments after 5 years with a 10 year maturity period. Toggle Notes Toggle notes pay increased interest rates after a certain period. Investors expect higher interest rates with a deferred payment condition.

Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred Coupon bonds help businesses acquire finance without paying periodic interest. A lump-sum is paid including interest at the time of maturity. ... a company paying 4% interest on step-up bonds defers interest payments till maturity. On maturity, the company will pay interest at an increased rate (say) 5.5% for all the deferred periods. ...

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

Types of bonds based on cash flows - Fixed Income - AlphaBetaPrep A step-up coupon bond is a bond, either fixed or variable, whose spread increases incrementally over the life of the bond. Bonds with step-up coupons offer protection against rising market interest rates. It is because when market interest rates increase, the bond's coupon rates also increase thereby limiting any decrease in bond value. ...

What Is a Step-up Bond? - The Balance But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work

Step-Up Bonds | Meaning, Single, Multiple, Callable Bonds, Benefits-Risks Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to...

What is a Step-Up Bond? - Accounting Hub A step-up bond comes with a lower interest rate initially. Its interest rate steps up after a specific period as described by the issuer. The interest rate of this bond can increase over specified intervals and up to a specified extent. It can be a single increase in the interest rate and several hikes depending on the terms of the bond.

Post a Comment for "40 step up coupon bonds"