43 consider a bond paying a coupon rate of 10 per year semiannually when the market

1. Consider a bond paying a coupon rate of 10% per year... get 5 - Quesba Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid. Consider a bond paying a coupon rate of 10% per year semiann | Quizlet Find step-by-step Economics solutions and your answer to the following textbook question: Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid..

Answered: Consider a bond paying a coupon rate of… | bartleby Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? check_circle Expert Answer

Consider a bond paying a coupon rate of 10 per year semiannually when the market

Consider a bond paying a coupon rate of 10% per - SolutionInn Consider a bond paying a coupon rate of 10% per. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. 4. Consider a bond paying a coupon rate of 10% per | Chegg.com Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's price today and 6 months from now after the next coupon is paid. What is the 6-month holding-period return on this bond? Question: 4. Investments-HW8-solutions.pdf - Solution for Assignment 8 Q1. Consider ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Solution: a. The bond pays $50 every 6 ...

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ... Answered: Consider a bond paying a coupon rate of… | bartleby Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid Question Foundations of Finance - Class 8 and 9 - Quizlet A coupon bond selling at par and paying a 10% coupon semiannually. 7. Treasury bonds paying an 8% coupon rate with semiannual payments currently sell at par value. ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's ... OneClass: Consider a bond paying a coupon rate of 10% per year ... 28 Sep 2019 Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b.

Chapter 10 Connect Flashcards - Quizlet Find the bond's price today and six months from now after the next coupon is paid. Current price: $1,068.72. Price after six months: $1,061.29. Consider a bond paying a coupon rate of 10.25% per year semiannually when the market interest rate is only 4.1% per half-year. Consider a bond paying a coupon rate of 10% per year semiannually when ... 12/13/2019 Business College answered Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%. The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be constant during the following 6 months. b. Consider a bond paying a coupon rate of 10 per year - Course Hero The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year. file-2.pdf - Fixed-Income Securities Prof. Shijie Deng Georgia ... Fixed-Income Securities Prof. Shijie Deng Georgia Institute of Technology The Market For Future Cash n Savings Deposits Offered by: ... Explicit Formula n Consider a bond with a coupon rate c per period, yield y per period ... Invest in Purpose 1-year T bills 10-year zero-coupon bond Pay off an obligation next year little risk interest rate ...

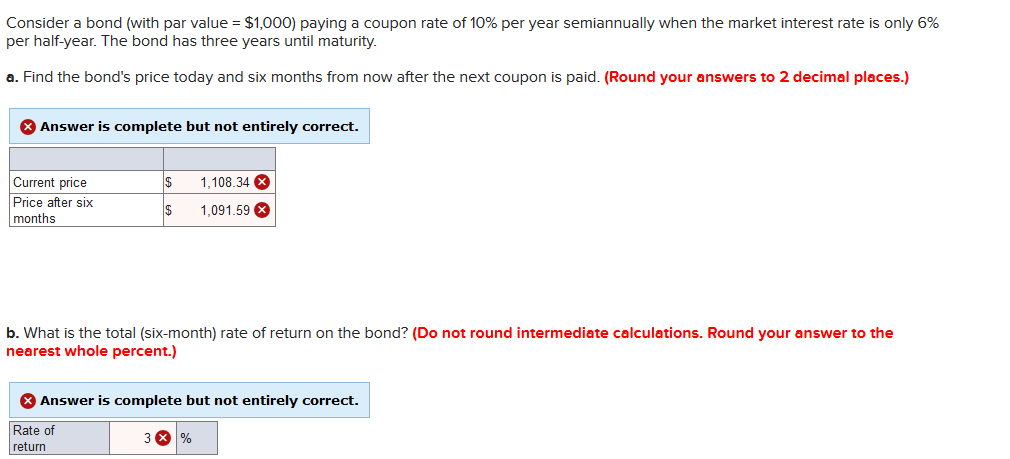

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? Yield to Maturity and Default Risk - Rate Return - Do Financial Blog Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. ... Consider a five-year bond with a 10% coupon that has a present yield to maturity of 8%. If ... Bond valuation Bond fundamentals most corporate bonds pay interest ... See Page 1. Bond valuation Bond fundamentals most corporate bonds pay interest semiannually at a stated coupon rate (set by the issuing company at the time of the issea, it represents the annual rate of interest that the firm is commited to pay over the life of thebond); Have an initial maturity of 10 to 30 years; and have a par value ... Solved Consider a bond (with par value = $1,000) paying a | Chegg.com Question: Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 5% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Post a Comment for "43 consider a bond paying a coupon rate of 10 per year semiannually when the market"